The Federal Motor Carrier Safety Administration (FMCSA) implemented the Compliance, Safety, Accountability (CSA) program to improve the safety performance of commercial motor carriers.

As a truck driver or fleet manager, maintaining a good CSA score is crucial to ensure the safety of your drivers and vehicles and potentially lower your insurance rates.

A lower CSA score can also enhance your company’s reputation for being safe among insurance companies. It shows that you take compliance seriously and are committed to maintaining a safe operation.

In addition, a lower CSA score may make you eligible for certain insurance discounts and incentives. Insurance companies often offer better rates to companies with good safety records, which are considered lower risks.

How Compliance Review Works

The FMCSA conducts regular compliance reviews to evaluate motor carriers’ compliance with safety regulations. These reviews can be conducted at any time by certified internal auditors or third-party compliance auditors:

- Scheduling and Notification: The FMCSA schedules compliance reviews for motor carriers. Carriers receive a notification indicating the date and purpose of the audit.

- Initial Interview: An initial interview is conducted with the carrier’s management to understand the company’s safety practices and management controls.

- Documents Review: Auditors examine various documents, including driver qualification files, hours of service records, vehicle maintenance records, and drug and alcohol testing results.

- Safety Measurement System (SMS) Evaluation: Auditors use FMCSA’s Safety Measurement System data to evaluate the carrier’s performance.

- Report and Findings: A detailed report summarizing the findings, violations (if any), and recommendations for improvement is developed.

- Corrective Actions: Motor carriers are required to implement corrective actions to address any identified deficiencies based on the review findings.

- Follow-Up: A follow-up review or audit may be conducted to ensure that the recommended corrective actions have been implemented and are effective.

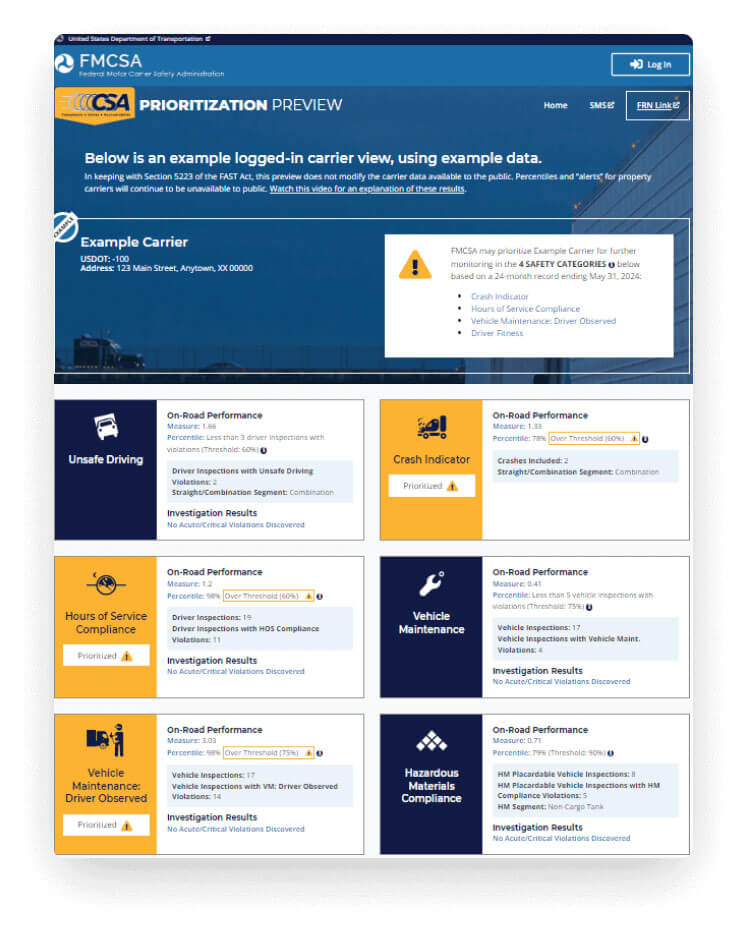

One important aspect of the compliance review process is the Safety Measurement System (SMS) score. This score measures the performance of motor carriers based on established standards called Behavior Analysis and Safety Improvement Categories (BASICs):

- Unsafe Driving

- Hours of Service Compliance

- Driver Fitness

- Controlled Substances and Alcohol

- Vehicle Maintenance

- Hazardous Materials Compliance,

- Crash Indicator

The higher the score in each BASIC category, the greater the risk for insurance companies. Therefore, maintaining a good SMS score is potentially crucial to lowering your insurance rates.

At DOT Compliance Group, we specialize in conducting and establishing a compliance review program for trucking companies.

Our team of experienced compliance review professionals will thoroughly review your operations and identify any areas that may negatively impact your SMS score.

What is a CSA (Compliance, Safety, Accountability) Score?

A Compliance, Safety, Accountability (CSA) score measures motor carriers’ safety performance based on SMS scores. This score is used by the FMCSA to identify high-risk carriers and prioritize them for interventions.

- A high CSA score can result in stricter enforcement actions, such as fines and out-of-service orders, which can negatively impact your company’s reputation and operations.

- However, with a lower CSA score, you can benefit from incentives such as insurance discounts and better rates.

You can use the CSA Score Lookup tool provided by the FMCSA to check your CSA score. This tool lets you see your company’s CSA scores and any associated BASIC scores.

Why do you need to monitor your CSA Score?

Risk assessments through compliance reviews can uncover potential issues and areas for improvement.

Through regular monitoring of your CSA score, you can also identify any negative trends and take corrective actions to improve your safety performance.

Failing to monitor your CSA score can result in higher insurance rates, stricter enforcement actions, and a damaged reputation. It also risks the safety of your drivers and vehicles.

Insurance Rates and Compliance Reviews

In sum, insurance companies often use the CSA and SMS scores to assess a motor carrier’s safety performance:

- A higher score in any of the BASIC categories can increase insurance rates, indicating potentially higher risks.

- Maintaining a good SMS and CSA score can make you eligible for insurance discounts and incentives.

- Regular compliance reviews can help you identify areas that may negatively impact your safety record and take corrective actions before they become problematic.

Preparing for a Compliance Review with DOT Compliance Group

While compliance reviews can be conducted anytime, being prepared can increase your chances of success. Here are some steps to help you prepare for a compliance review:

- Educate yourself and your staff on CSA regulations and safety measures.

- Review your records and documentation regularly to ensure they are accurate and up-to-date.

- Identify any potential issues or areas for improvement through regular self-audits.

- Address any identified deficiencies promptly, taking corrective actions as necessary.

- Utilize resources such as DOT Compliance Group to assist you in establishing a compliance review program and providing guidance.

At DOT Compliance Group, we offer ongoing support to help you maintain a good CSA score. We offer regular compliance reviews to identify potential risks and provide guidance on improving your safety record.

With our assistance, you can potentially lower your insurance rates and ensure the safety of your drivers and vehicles.

Contact us today to learn how we can help you with your compliance review needs.

0 Comments