Consistent cash flow is critical to every business, but more so for the freight trucking industry, where expenses such as fuel, repairs, and driver salaries must be paid regularly.

However, traditional freight factoring services may not always be the best solution. This is where true non-recourse factoring comes in.

True non-recourse factoring is a financing option that allows businesses to secure their cash flow without taking on any risk.

Unlike traditional recourse factoring — in which the factor can go after the business for unpaid invoices if the customer does not pay — true non-recourse factoring provides complete protection to businesses against customer defaults.

What Is Factoring?

Factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discount.

This process mainly benefits the trucking industry, where businesses often face cash flow challenges due to delayed customer payments.

By factoring their invoices, trucking companies can access immediate funds, allowing them to cover operational costs and invest in growth without waiting for clients to settle their bills.

How Invoice Factoring Works

In invoice factoring, the factoring company assumes responsibility for collecting payments from customers. The process typically involves the following steps:

- A trucking company performs a service or delivers goods to a customer.

- The trucking company generates an invoice and sends it to the factoring company.

- The factoring company purchases the invoices after verifying their validity. Then, the factoring company pays the trucking company a percentage of the total invoice amount, usually within 24 hours.

- The factoring company collects payment from the customer on behalf of the trucking company.

- Once the customer pays, the remaining balance is paid to the trucking company minus any fees or charges.

Additionally, there are two types of factoring agreements: recourse factoring and non-recourse factoring:

How Recourse Factoring Agreement Works

- The trucking company sells its receivables to the factoring company but retains some risk.

- If the customer fails to pay the invoice, the factoring company can demand repayment from the trucking company.

- Typically, it offers lower fees due to the risk transfer back to the trucking company.

- It is more suitable for businesses with reliable customers who usually pay their invoices.

How Non-Recourse Factoring Agreement Works

- The trucking company sells its receivables and transfers all risks associated with customer defaults to the factoring company.

- The trucking company is not held responsible for the unpaid invoice if a customer does not pay.

- Usually, it comes with higher fees due to the increased risk the factoring company takes.

- Ideal for businesses seeking to eliminate the risk of customer non-payment and ensure steady cash flow.

Benefits of Factoring for the Trucking Industry

Factoring agreements, both recourse factoring and non recourse factoring, offer several benefits to businesses:

- Improved Cash Flow: Provides immediate access to cash, allowing timely payment of expenses such as fuel, maintenance, and driver wages.

- Reduced Risk: True non-recourse factoring protects businesses from customer defaults, offering peace of mind.

- Faster Funding: Quick processing of invoices means companies can receive funds within 24 to 48 hours.

- No Debt Incurred: Factoring does not involve taking on additional loans or debt, as it’s a sale of assets rather than borrowing.

- Focus on Growth: With stable cash flow, trucking companies can invest in expansion opportunities rather than stressing over unpaid invoices.

- Professional Credit Control: Factors often provide credit analysis and collections support, which can alleviate administrative burdens for trucking companies.

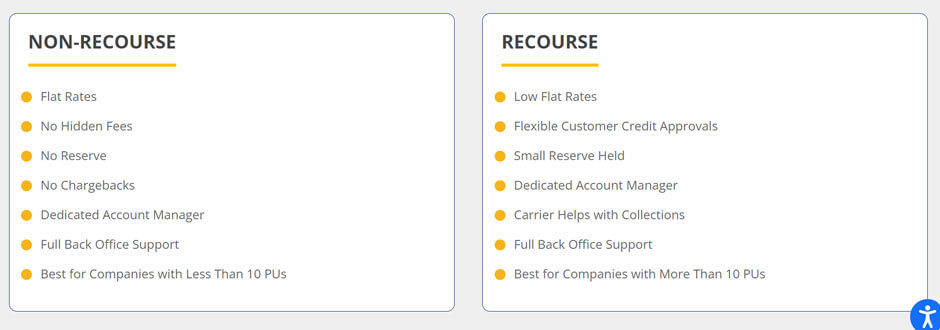

Recourse vs Non-Recourse Factoring: What Are the Differences?

The differences between recourse factoring and non-recourse factoring are primarily in the risk level taken by the factoring company and the associated fees.

Non-Recourse Factoring

In non-recourse factoring agreements, the factoring company assumes the credit risk associated with an unpaid invoice, including disputes or customer insolvencies.

As a result, non-recourse factoring often comes at a higher cost to the trucking company. However, this option provides complete risk protection for small business owners who may have unreliable customers or are in industries with high levels of customer defaults.

Recourse Factoring

On the other hand, recourse factoring agreements transfer some credit risk back to the trucking company, as they are held responsible if a customer does not pay their invoice.

This option typically includes lower fees than non-recourse factoring and is suitable for businesses with reliable customers who consistently fulfill timely payments.

In Sum: Recourse vs Non-Recourse Factoring

Non-Recourse Invoice Factoring: Key Details

- Lower advanced rates

- Higher fees

- Full risk protection for businesses

- Suitable for companies with customers with poor payment histories or in industries with high levels of customer defaults.

Recourse Invoice Factoring: Key Details

- Higher advanced rates

- Lower fees

- Some risk transfer back to the trucking company

- Ideal for businesses with reliable customers with solid payment histories.

Securing Cash Flow for Trucking Businesses with Non-Recourse Factoring

For commercial vehicle operators, steady cash flow is crucial for the smooth running of operations. Non-recourse factoring offers several ways to secure this financial stability:

- Insurance Against Customer Defaults: By transferring credit risk to the factoring company, trucking businesses are protected against customer non-payment.

- Access to Immediate Funds: With a factor purchasing their invoices, trucking companies can access funds within 24 hours, eliminating long wait times for customers’ payments.

- Professional Credit Control Services: Factoring companies often provide support with credit analysis and collections, reducing administrative burdens for trucking businesses.

- Flexibility in Funding: Non-recourse factoring provides businesses with more options and flexibility in funding compared to traditional loans or lines of credit.

- No Additional Debt: With factoring, trucking businesses sell their invoices and do not incur any debt, reducing liabilities on the balance sheet.

However, not all factoring companies that offer non-recourse factoring are true to their word. A true non-recourse factoring company will have a clause in their agreement stating that they take full responsibility for the credit risk associated with unpaid invoices. It’s essential to thoroughly understand the terms and conditions before signing up with a factoring company.

Why You Need a Reputable Factoring Company

Factoring companies serve as financial partners to trucking businesses, providing stable cash flow and expert support. When looking for a factoring company, it is essential to choose a reputable and experienced partner that understands the unique needs of the trucking industry.

A reputable factoring company can offer:

- Industry Expertise: A reliable factor should have experience working with trucking companies and understand the complexities of the industry.

- Quick Processing Times: Fast invoice processing means quicker access to funds for trucking businesses, ensuring timely payment of expenses and steady cash flow.

- True Non-Recourse Factoring: As shown above, non-recourse factoring provides maximum risk protection for businesses. Ensure that your chosen factoring company offers true non-recourse options.

- Competitive Rates: Look for a factoring company that offers competitive rates and transparent pricing so you know exactly what to expect.

- Professional Credit Control Services: Having an expert team handling credit analysis and collections can alleviate administrative burdens for trucking companies, allowing them to focus on growth opportunities.

Why Work with OTR for Your Freight Factoring Needs

With the right factoring partner, trucking businesses can enjoy the benefits of steady cash flow and risk protection without taking on additional debt or liabilities.

At DOT Compliance Group, we offer true non-recourse factoring to protect your business against credit risks through OTR Solutions. Their team is experienced in working with businesses in the transportation industry, and we provide quick processing times, competitive rates, and professional credit control services.

With true non-recourse factoring, you can focus on expanding your business without worrying about unpaid invoices or unreliable customers.

Choose DOT Compliance Group and OTR Solutions as your trusted factoring partner and secure financial stability for your trucking business today.

Contact us or speak with an agent today to get started!

0 Comments